Target Road School was part of the Upper Harbour Sorted Schools (UHSS) during 2014 and 2015. This initiative, organised by the Commission for Financial Capability, focused on embedding financial capability across the curriculum.

The aim of the UHSS was to improve engagement with financial capability across an entire school: teachers, students, and the surrounding community.

In this school snapshot, Christine Templeton, Deputy Principal of Target Road School, describes how and why they have drawn their community into learning about financial capability.

Why do you involve parents and whānau in financial capability?

Our mission statement at Target Road School states that parents and caregivers are valued as partners in education. We believe that it takes a community to raise a child and that children’s learning is enhanced when parents are involved. We share our financial capability projects with parents and whānau as much as possible so that they have an understanding of what their children are learning at school and conversations can carry on at home.

Involving our community in financial capability is also about improving parents’ skills with money. The aim of the Upper Harbour Sorted Schools cluster is to improve engagement with financial capability across the entire school community – students, teachers, parents, and whānau. We believe that if our parents and whānau have better financial capability then it will flow to the children. Positive financial behaviours will be passed on and students will be receiving the same messages about money from home and school.

Financial capability and the future focus principle

Financial capability is a context that can be used to bring the future focus principle to life. Through a financial capability programme, students can explore what it means to be a citizen, and to contribute to the development and wellbeing of society. Financial capabilities are necessary for students to be able to engage in enterprising activities.

How do you involve parents and whānau?

School newsletter

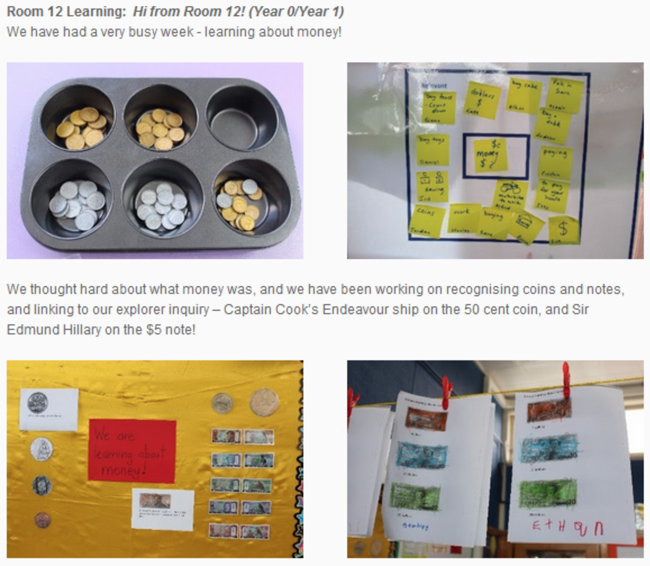

Our weekly newsletter is one way that we keep our parents and whānau informed of what the students have been learning. We describe some of the financial capability activities that the classes have been involved in and include photographs of the children and their work.

We also use our newsletter to provide financial advice to families who might need it. We have established a close relationship with New Zealand Home Loans and we have permission to use excerpts from their articles in our school newsletters. Links to useful websites about money are included in our newsletters. Two websites that we have recently promoted include:

Market day

At the end of 2014 we held our first market day at school, which was a fun and effective way of sharing our financial capability learning with parents, whānau, and the wider community.

All students had to make and sell products at our market day which was held in conjunction with our Christmas carol evening. The students prepared a range of food stalls and also sold plants, lucky dips, Christmas decorations, and crafts. Parents, whānau, and people living in the local community came along to buy the goods for sale. The event was hugely successful, both for the financial learning that our students gained as well as the connections we made with our community.

We now hold a market day every year to extend our students’ financial capability and build stronger links with whānau and the wider community.

Money Matters evenings

Another way that we engage our community is through our Money Matters evenings. We hold these special evenings at our school as a way of offering financial information and services to parents, whānau, and the wider community.

Representatives from the Citizens Advice Bureau, Enable Me, major banks, and budget advisors set up information stalls in our school library and we invite our community to visit the stalls and enjoy coffee and cake while they chat to the experts. Money Matters evenings are held on the same night as our school disco so that parents can pop in once they have dropped off their children.

What we have noticed from Money Matters evenings is that people seek financial information relevant to their situation and needs. One parent and one teacher got a better mortgage deal after talking to someone at this event. Parents have also sought information about joining Kiwisaver and setting up bank accounts for their children.

Community engagement principle

Target Road School enacts the community engagement principle by supporting students, parents, and whānau in financial capability. This strengthens home-school partnerships and enables whānau to be more deeply involved in students' learning and empowered in their own lives.

Next steps

We want to keep growing financial capability at our school because it is something that our students and parents value.

“When you grow up you need to know how to deal with all the problems about money. You need to know how to spend money more carefully.”

Student

"Learning about money is really important as our children could accrue a great amount of debt in their lifetime, and if they can learn to manage it they won't get into bad situations."

Parent

Our school newsletter continues to be a forum for sharing students’ work and financial advice for families. We plan to introduce a financial quiz for families based on information in our newsletters to encourage parents to read the financial capability articles more closely. Completed quizzes will be put into a draw for spot prizes.

Our market day is the biggest draw card for our community and a huge learning opportunity for our students. Next year we are thinking of combining our Money Matters event with our market day. Parents will come to support their children’s market stalls, but they could also be taken by their children to information stalls where they can talk to our budget or financial experts. By combining the events we can offer financial advice and support to a larger audience.

You might like

Financial capability in action

Find ideas, stories, templates, and lesson plans developed by the Upper Harbour Sorted Schools cluster. This material has been shared to help you build a stronger focus on financial capability in your own school settings.

- Tags:

- community engagement

- Financial capability

- future focus

- primary

Return to top